California Reverse Mortgage Law provides extra protections to seniors considering obtaining a reverse mortgage. Many have accused the Golden State of being regulation heavy, but in this case, the minor inconvenience goes a long way toward protecting what can often be a vulnerable population.

This short blog will cover the following:

1. Basic Reverse Mortgage Requirements

2. Additional Requirement for California Residents

Reverse Mortgage Basics

To qualify for a reverse mortgage a borrower needs to fulfill the following requirements.

Age – Potential applicants must be 62 years old or older. There is no upper age limit for an applicant. Also, federal laws prohibit discrimination in mortgage lending based on age. Thus, no matter how old an applicant is they are eligible to apply for a reverse mortgage.

Home Equity – The borrowers home must have sufficient equity to borrow against. The younger the borrower the greater the equity need be. With the changes made to the HECM reverse mortgage program in October of 2017, need greater equity than at any time since the financial collapse,

Counseling – To avoid confusion and misinformation, a potential borrower must attend a HECM reverse mortgage counseling session. These sessions are offered in-person and over-the-phone. The counseling will cover most of the major questions regarding reverse mortgages and will allow for questions to be answered.

California

Prior to taking the counseling session, and prior to the senior providing the loan officer with a completed reverse mortgage loan application, California reverse mortgage law provides 2 additional disclosures and a cooling off period.

The Important Notice to Reverse Mortgage Loan Applicant form is required by state law and must be signed before the borrower begins the application process. The form advises prospective borrowers that they are considering entering into a binding legal agreement, that they are required to attend counseling and that while allowed senior groups advise against using the proceeds from a reverse mortgage to purchase an annuity.

California Reverse Mortgage Worksheet Guide

Also, Californians are required to sign the form “Reverse Mortgage Worksheet Guide – Is a Reverse Mortgage Right for Me?”. This form contains five of the more commonly asked questions with regard to a reverse mortgage. They are:

1. What happens to others in your home after you die or move out? Answer – Once the borrower dies, moves or is absent from the property for 12 months, the loan becomes due.

2. Do you know that you can default on a reverse mortgage? – Importantly, there are obligations to a reverse mortgage and if they are not maintained the loan can be placed in default and lead to foreclosure. You are required to pay your property taxes, insurance, and maintenance.

3. Have you fully explored other options?

4. Are you intending to use the reverse mortgage to purchase another financial product?

5. Do you know that a reverse mortgage may impact your eligibility for government assistance programs? – Income received from investments will count against individuals seeking government assistance.

The reverse mortgage worksheet guide will direct the potential borrower to ask their HECM reverse mortgage counselor about any of these questions they are unclear on.

HUD Counseling

Finally, a potential borrower should receive a list of approved HECM reverse mortgage counselors. The list will provide the name, phone number, and address of counselors in their area.

California Cooling

The last line of California reverse mortgage law safeguards is the 7 day cooling off period. Once an individual has completed the required reverse mortgage counseling, a 7 day “cooling off period” is required to give the potential borrower the opportunity to rethink the decision. After completion of this period, the application can be taken and submitted to the lender and the reverse mortgage underwriting process begun.

Federal Right of Recision

Although not part of California reverse mortgage law, the true final line of defense is the federally mandated 3 day right of rescission. This is the 3 day period (not to include federal holidays or Sundays) immediately following the signing of the loan documents. During this time, should the borrower change their mind, the transaction can be canceled.

Summing Up

Summing Up

In summary, California reverse mortgage law has done it’s best to protect vulnerable seniors from potentially predatory transactions with multiple layers of protection. Ample disclosures and multiple cooling off periods provide seniors with the time they need to be sure that a HECM reverse mortgage is the right transaction for them. An HCEM reverse mortgage can be a powerful tool for seniors, but it isn’t the right tool for all seniors. California has done its part to try and make sure that all seniors get to make this determination!

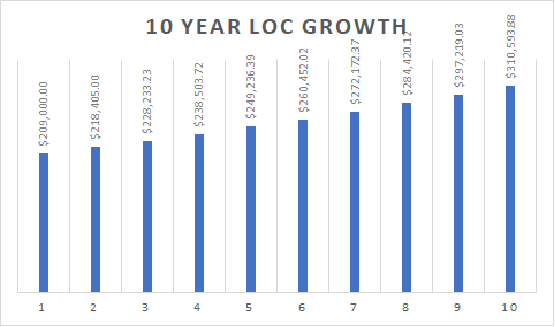

There are many other features to the HECM reverse mortgage including the reverse mortgage line of credit, the HECM reverse mortgage for purchase program, and many others. If you have questions about these or any other reverse mortgage or lending-related item please click a link or contact us through our contact page.

Truehecm.com

We here at truehecm.com are always listening. If you have a question or comment please reach out to us. You can comment below or you can contact us through our contact page. We would also love your feedback through a

review!

And, if you are in California, our HECM reverse mortgage specialists are always ready to help you determine if the program is right for you. Just drop us a line through the contact page and well get to you ASAP!

Also, check out our about page for a little more information about us!

For additional reading try:

FHA Reverse Mortgages (HECMs) For Seniors

California Law: What to know about reverse mortgages

About the author: Sean Thomas is a businessman, brokerage owner, blogger, athlete, father, and husband. Not necessarily in that order! Having been in the mortgage and real estate industry since 2005 he has a deep knowledge of the real estate and mortgages their trends and quirks. Follow Sean on Twitter for more tips, information, and musings.