How the Reverse Mortgage Line of Credit Works

Making the right decision regarding a reverse mortgage includes deciding on the type of HECM reverse mortgage. The reverse mortgage line of credit is a very powerful option in the suite of reverse mortgage choices. Often overlooked due to borrowers reluctance to tie themselves to an adjustable rate loan, the LOC option can be flexible and provide long-term security that many of the other HECM options do not.

What is a HECM?

At the risk of boring some of my readers, let me at least summarize what a reverse mortgage is (in case you happened on this page before viewing a description of reverse mortgages).

A Home Equity Conversion Mortgage (HECM for short) is a federally insured reverse mortgage. Reverse mortgages use the equity in your home to pay you and/or allow you to live in the property mortgage free. It’s a very simple concept, the money you have built up in your home is gradually released back to you!

How do I get paid?

The HECM reverse mortgage has four options for paying you. They are:

Lump Sum – Much as it says in the title, the loan disburses a one-time lump sum payment to you. Any remaining funds are used to maintain the loan payments and allow you to live in the home mortgage payment free. The Lump Sum option can be, and is often, paired with the line of credit (LOC) option we will discuss momentarily.

Term Payments – Term payments are simply taking the lump sum you would have received and dividing it out over a number of months and having those payments sent to you. For example:

Lump Sum Distribution: $100,000

Term Months 20

Term Payment = $100,000/20 = $5000 per month

Often, term payments provide a system of secure payments while also allowing for a modicum of control for those of us that are likely to let a lump sum payment burn a hole in your pocket!

Tenure Payments – Tenure payments are like term payments but are guaranteed for life. You will receive your payment as long as you are alive and own the home and are living there. Certainly some great security, but generally substantially smaller payment amounts.

Line of Credit (LOC) – The reverse mortgage line of credit works by providing you with a reserve of funds available at your convenience. The funds are essentially stored for your use and you can access them at your leisure. The bonus is that they actually grow with time! In fact, many seniors use the lineup credit with a reverse purchase mortgage and line of credit. (Try the link if you’d like more information on the reverse purchase loan)

The HECM Line of Credit

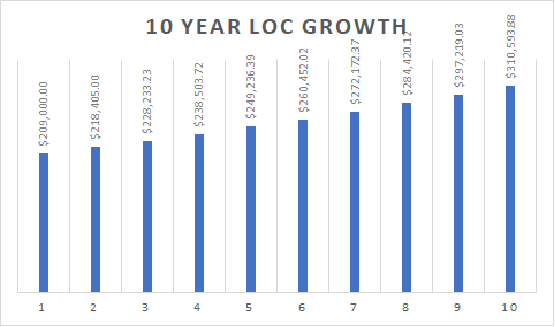

One of the greatest benefits of how the reverse mortgage line of credit works is that the unused portion of the line of credit grows at the loans interest rate. So if the loans interest rate is 4.5% then the line of credit will grow by 4.5% per year. Assuming a $200,00 line of credit untouched for 10 years, here is an illustrated example:

So as you can see, in 10 years your line of credit would have grown by over $100,000! That’ some pretty sweet purchasing power!

Only pay for what you use!

Another benefit to how the reverse mortgage line of credit works is that you’re essentially only charged for what you use! What I mean by that is that you only pay interest on the portion of the LOC that you’ve accessed. So if you have a $200,000 line of credit and you’ve only drawn $30,000 of that line, you will only be paying interest on the $30,000. You have access to the other $170,000 but aren’t charged interest for it until you use it.

Additionally, you are always allowed to pay down the mortgage balance or line of credit at any time. So say you hit the lotto and you want to pay the loan off, you are more than welcome to. Without penalty of any kind!

Options

This all feeds into the overall flexibility the line of credit provides the reverse mortgage. You will have complete control of not only the funds but when and how you access those funds. This means that you won’t be offsetting the interest you earn on the money you would receive a lump sum by paying interest on them in the mortgage.

We also all know that the rates that banks lend money are FAR higher than the rates they pay on deposits, well this is your opportunity to turn the tables. The rate of interest on your line of credit will be the same as the rate of interest you would borrow.

Finally, LOC interest rates generally outpace the rate at which homes increase in value, thus, for the portion of the value of your home that is represented by your LOC, your home value will grow faster than the 2% that homes generally grow. This is a huge advantage. During the financial crisis of 2008, had you had a HECM reverse mortgage line of credit your home could have essentially gained in value rather than sinking with the rest of the market!

Always consider….

I can’t think of anything in life that does not have a flip side and LOC’s are no different.

One turnoff for many people is that the HECM requires that the LOC be combined with the adjustable rate program. You are not able to get the LOC on the HECM fixed rate mortgage. This means that you will be subject to whims of the rate market.

Being subject to the rate market is difficult in these time as we are in a rising rate environment. The good thing is that while you are subject to rising rates, you also benefit from them through the growth of your credit line.

One last item on rates, because of the nature of how HECM reverse mortgage limits are calculated, should you want a reverse mortgage, please take advantage of the program sooner rather than later. Rising rates equal lower loan amounts. So the sooner you lock in your HECM loan, the better.

Summing up.

In summary, the HECM reverse mortgage line of credit is a strong tool for borrowers. If used properly it can provide tremendous peace of mind by adding a safe and secure reserve for seniors.

We here at truehecm.com are always listening. If you have a question or comment please reach out to us. You can comment below or you can contact us through our contact page. We would also love your feedback through a

review as well!

And, if you are in California, our HECM reverse mortgage specialists are always ready to help you determine if the program is right for you. Just drop us a line through the contact page and well get to you ASAP!

Also, check out our about page for a little more information about us!

For additional reading try:

Reverse Mortgages: A Risk Management Tool for Retirement Distributions

How Does The Line Of Credit For A Reverse Mortgage Work?

About the author: Sean Thomas is a businessman, brokerage owner, blogger, athlete, father, and husband. Not necessarily in that order! Having been in the mortgage and real estate industry since 2005 he has a deep knowledge of the real estate and mortgages their trends and quirks. Follow Sean on Twitter for more tips, information, and musings.