Can reverse mortgages help solve credit card debt?

Seniors are often financially unprepared for retirement. Unfortunately, many retirees are saddled with excess debt and little in the way of retirement savings. With declining income prospects it is important for seniors to find a way to stop the debt bleeding as soon as possible. One question I’ve been asked is can reverse mortgages help solve credit card debt? And the short answer is yes, but let’s get a bit more extensive answer.

What is a reverse mortgage?

I always like to start with a general understanding of what the FHA home equity conversion mortgage is. If you are familiar with the loan please feel free to skip ahead.

Home Equity Conversion Mortgages (HECM for short) are a federally insured reverse mortgage. Reverse mortgages use the equity in your home to pay you and/or allow you to live in the property mortgage free. It’s a very simple concept, the money you have built up in your home is gradually released back to you! The HECM reverse mortgage has four options for paying you.

How can I get paid?

Lump Sum – The loan disburses a one-time lump sum payment to you. Seniors use the remaining home equity funds to maintain the loan payments and live in the home mortgage payment free. The Lump Sum option can be, and is often, paired with the line of credit (LOC) option we will discuss momentarily.

Term Payments – Term payments are simply taking the lump sum you would have received and dividing it out over the numbers of months of your choosing. For example:

Lump Sum Distribution: $100,000

Term Months 20

Term Payment = $100,000/20 = $5000 per month

Tenure Payments – Tenure payments are like term payments but are guaranteed for life. You will receive your payment as long as you are alive and own the home and are living there. Certainly some great security, but generally substantially smaller payment amounts.

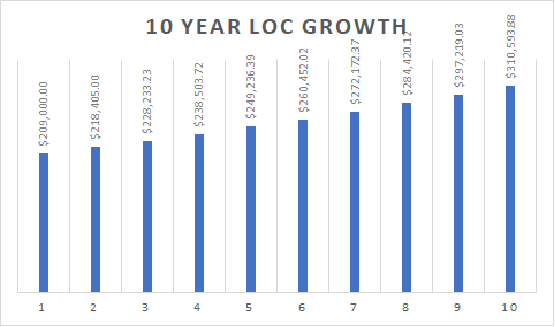

Line of Credit (LOC) – The reverse mortgage line of credit works by providing you with a reserve of funds available at your convenience. Lines of credit are stored funds that you can access when you need them.

Credit card corrosion!

Now that we have a handle on what a reverse mortgage is let’s get to the meat of the problem, controlling credit card debt with a reverse mortgage. Retirement is a game of making your resources last as long as possible while maintaining your lifestyle. This can often be a difficult balancing act!

Credit cards are one of the most corrosive forms of debt a senior can have when trying to find the financial balance needed to retire. Per Creditcard.com the average credit card APR is roughly 16%! As you can imagine that kind of interest rate is unsustainable.

Let’s say you were carrying $5000 in credit card debt. With an APR of 16%, your yearly interest on that debt would be roughly $800 per year. Now let’s be honest, many of us are carrying far more than $5000 in credit card debt and $800 or more per year adds up fast over a few years or retirement.

Add to that we are in a fast-rising interest rate environment, and for all intents and purposes, all credit cards are adjustable rate. This means that while you may be paying 16% today you could easily be paying a far higher rate next month, let alone the end of the year!

Can a reverse mortgage help solve credit card debt? Yes! For the right client.

First, paying the debt off is always the best option for dealing with credit card debt. This may not be an option for a senior on a tight budget.

The second best option for dealing with the debt is reducing the interest rate. What if you were able to reduce that interest from 16% to 5%?

That same $5000 in credit card debt at a 5% APR would incur interest of $240 per year. That would reduce the yearly interest by $560 which is a 70% reduction on the carrying cost for that debt. While not perfect it certainly makes maintaining the debt much more sustainable.

This is where a reverse mortgage comes in. A reverse mortgage with an interest rate of 5% would provide the relief we just discussed. Reducing the carrying cost of your debt allows the funds you’ve saved to go a lot further.

Also, unlike credit cards, a reverse mortgage does not have to be paid until the retiree moves or passes away. This can be the difference between making it in retirement and not.

Further, reverse mortgages come with the guarantee that the homeowner can stay in the home as long as they maintain the taxes, insurance, and home. A HECM reverse mortgage is one of the only ways that a retiree can unlock the equity in their home and remain secure that they will have their home through retirement.

Reverse mortgages also offer the added benefit of allowing for a line of credit that grows at the interest rate of the loan. A line of credit is excellent as an emergency fund rather than using high-interest rate credit cards. Again, keeping interest rates, and thus costs, down in retirement is a key to success.

Summing up!

So, in summary, can reverse mortgages help solve credit card debt? Yes! Paying high-interest credit cards with a HECM reverse mortgage is not the only solution, but it is an excellent option for a number of potential or actual retirees. Reducing costs and stretching your dollars is the name of the game in retirement and a HECM reverse mortgage is an excellent way to achieve this goal.

Truehecm.com

We here at truehecm.com are always listening. If you have a question or comment please reach out to us. You can comment below or you can contact us through our contact page. If you find the info helpful we would also love your feedback by giving as a 5-star review!

And, if you are in California, our HECM reverse mortgage specialists are always ready to help you determine if the program is right for you. Just drop us a line through the contact page and well get to you ASAP!

Also, check out our about page for a little more information about us!