How does a reverse mortgage work? A reverse mortgage is a financial product specifically designed to allow homeowners 62 years of age or older to plan for retirement by accessing a portion of the equity locked in their home. As opposed to a forward mortgage, where the borrower pays a mortgage payment each month, thereby reducing their mortgage balance and increasing equity, with a reverse mortgage the mortgage payment is added to the loan balance each month and reduces the equity. Reverse mortgages are exactly as the name describes: a forward mortgage in reverse.

Highlights:

- Eliminates monthly out-of-pocket mortgage payments

- Can provide tax-free funds for retirement income, savings, repairs or almost any other use

- Available equity is based on the age of the youngest borrower

- You retain ownership of your home and you may repay or refinance the loan or sell the home at any time

- The loan is repaid when you either no longer occupy your home as your primary residence or you pass away

- Any remaining equity belongs to you or your heir

Loan Requirements:

The standard Home Equity Conversion Mortgage (HECM) or reverse mortgage has some basic requirements that all borrowers must meet:

The first is “Age” – All borrowers on the loan must be 62 years of age or older when the loan is closed. This means that if a husband and wife applied for the loan, each must be at least 62 or older. Further, anyone that is on the title to the property must be 62 or older.

Second is “Equity” – Generally, your home must have at least 50% or greater equity to be viable for a reverse mortgage. That number is very general as the actual amount of accessible equity is based on the age of the youngest borrower. The older the borrower the more equity you can access.

Third, the property must be your “Principal Residence” – The property must be your principal residence meaning that you live in the property at least nine months of the year as defined by Housing and Urban Development (HUD).

Credit – In 2017 HUD updated their financial assessment guidelines. This created true credit requirements. That said poor credit can almost always be overcome. You can find more details about credit with this linked post.

Income – HUD also instituted a financial assessment with minimum residual income requirements. Residual income is defined as income left after accounting for current expenses. The requirements are based on family size and region. For the actual chart please check this link.

Reverse mortgage payment options:

Many seniors use reverse mortgages to eliminate a monthly mortgage payment, and unlike a forward mortgage, a HECM reverse mortgage can pay you! If the equity is available there are four ways in which you can collect funds from your reverse mortgage. They are a “Lump Sum” payment, a “Term” payment, a “Tenure” payment or a “Line of Credit”. Let’s take a brief look at each:

Lump Sum Payment:

Probably the most common payment option for a reverse mortgage transaction is the lump sum payment. Just as is sounds, you receive one lump sum payment upon closing the loan. Fixed rate HECM reverse mortgages require a lump sum payment option and can not be combined with the other payment options.

Term Payment:

A “Term Payment” is a fixed payment amount that is paid for a fixed period of time. For example, you would get a payment of $1000 per month for the next 10 years. After the term is up you would no longer receive a payment but you would still remain in your home with no monthly mortgage payment due to the bank.

Tenure Payment:

A “Tenure Payment” is similar to a term payment in that it makes a fixed payment amount but for the life of the borrower rather than for a fixed period of time. For example, you would receive a payment of $500 for the rest of your life.

Line of Credit :

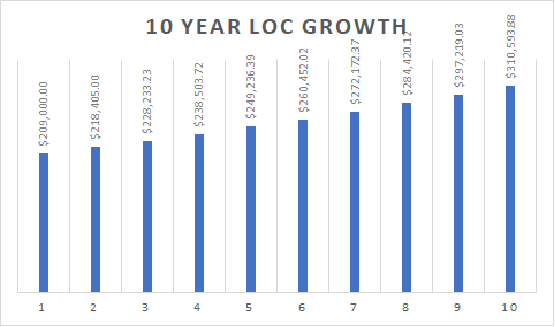

A HECM reverse mortgage “Line of Credit” operates just like a home equity line, meaning that you will have a sum of money that can be drawn upon at your discretion, but it has 2 major beneficial differences. One, the line doesn’t have to be paid back until a maturity event occurs and two, the line of credit grows at the loan’s interest rate for the life of the loan.

That second line of credit benefit is the one that excites retirees and their financial planners. The line of credit grows automatically and unaffected by the value of the home. Because it grows automatically it means that, theoretically, the line of credit could provide you with funds that would exceed the appraised value of your home. Further, each year your reserves will grow to provide you with additional layers to your safety net. That’s quite a useful tool!

Who can benefit from a reverse mortgage?

“How does a reverse mortgage work” has been covered, but WHO can benefit from a reverse mortgage is an important consideration. Some examples of who would benefit from a reverse mortgage are:

- Someone looking for additional reserves that grow with time

- Seniors that do not plan to move from their home

- Retirees looking to supplement their retirement savings

- People who need extra help maintaining their home or paying taxes and insurance

- Seniors looking to relocate can benefit from a reverse mortgage purchase loan

A reverse mortgage loan is not for everyone, but it does provide a very solid option for many seniors. Historically maligned, financial professionals have come to realize the reverse mortgage is a very useful product that is one of the very few ways people can access the paid-up equity in their home without selling the home. It may be the only way to access that equity without selling the home and without creating a mortgage or alternative loan payment!

The Hiers

One of the most pernicious myths related to reverse mortgages is that when you take a reverse mortgage or HECM you are signing your home over to the bank. This myth often concerns adult children or other family members of the homeowners. Let me be clear:

YOU DO NOT SIGN YOUR HOME OVER TO THE BANK WHEN YOU TAKE A REVERSE MORTGAGE!!!!

As with standard forward mortgages, you sign a note and create a debt obligation on the title to your home when you open a reverse mortgage. You still own your home! A maturity event occurs when either you no longer occupy the home as your primary residence or if you were to pass on. This maturity event means that the loan comes due and must be paid off within the next 12 months. Title to your property either stays in your name or passes to your heirs per your estate plan. Any equity in the property remains with you or your heirs. The bank is only entitled to recoup the funds needed to pay off the debt owed against the home.

The Down Side

As was mentioned before, reverse mortgages are not for everyone. While a very solid tool for many seniors reverse mortgages do require consideration.

Taxes, Insurance & Mantainence

While you will no longer have a monthly mortgage payment after obtaining a reverse mortgage you will still have obligations. The terms of a reverse mortgage require that you maintain the property and pay property taxes and homeowner’s insurance in a timely manner. It is very important that you keep up with property taxes and insurance as this is one of the main reasons homeowners run afoul of their reverse mortgage lender. There are ways to include your property taxes and insurance in the reverse mortgage loan and remove the responsibility of making those payments yourself. If you are concerned about tax and insurance payments, please ask your mortgage professional about a LESA, and we are always here to help at Ascent Lending/TrueHECM.com. Just drop us a line at our contact page or leave a comment and we will get back to you ASAP!

Costs:

Like all mortgage transactions, reverse mortgages have costs. These costs can include mortgage insurance, origination fees, third party fees, and servicing fees.

Mortgage Insurance – With the most common type of reverse mortgage, the FHA insured HECM reverse mortgage, you will have a mortgage insurance (MI) premium. The premium is two percent of the loan amount upfront and half a percent annually. This premium allows the Federal Housing Administration to guarantee reverse mortgage loans and lenders to offer them. Without them, the reverse mortgage may not exist.

Origination Fees – Lenders charge an origination fee generally from $2500 to a maximum of $6000. The FHA caps origination fees $6000.

Third Party Fees – Ther are a number of third-party fees associated with any loan and a reverse mortgage is no different. These fees may include (but are not limited too) appraisal fee, credit report fee, title fee, escrow fee, attorney’s fee, surveyor’s fee, flood certification. etc. Customary fees differ by location so consult with your loan representative.

Servicing Fees – Some lenders will charge a monthly servicing fee. FHA guidelines cap this fee at a maximum of $35 per month.

Summing Up.

How does a reverse mortgage work? A reverse mortgage works by allowing senior borrowers to access the cash equity in their home, without creating a new out-of-pocket mortgage payment. The homeowners have the right to remain in their home for the rest of their lives. There are obligations for this right, such as maintaining the upkeep on the home as well as keeping property taxes and insurance current, but all in all the program is a great option for a growing number of seniors.

Some of the benefits of the loan are:

- It can help supplement your retirement income

- It can help pay off an existing forward mortgage

- You can eliminate high-interest credit card debt

- Stretch your retirement savings

- Stay in your home for as long as you like up to the rest of your lifetime

There are four ways for a homeowner to access cash from their home when using a reverse mortgage.

- A lump sum payment at closing

- A term payment over a number of years

- A tenure payment for the life of the homeowner

- A line of credit that can be accessed by the homeowner as they see fit

The lump sum payment and line of credit are often used together in many reverse mortgage products. These payment options provide substantial flexibility and a reliable means of obtaining funds for reverse mortgage clients. While many seniors may just want to eliminate a mortgage payment, the available cash provided by these payment options provides peace of mind.

Truehecm.com

We here at Ascent Lending-TrueHecm.com are always listening. If you have a question or comment please reach out to us. You can comment below or you can contact us through our contact page. If you find the info helpful we would also love your feedback by giving us a 5-star review!

And, if you are in California, our HECM reverse mortgage specialists are always ready to help you determine if the program is right for you. Just drop us a line through the contact page and well get to you ASAP!

Also, check out our about page for a little more information about us!