Welcome to RM 101!

What is a reverse mortgage? Well here is where you will find the answer. In this post, we are going to endeavor to cover the basics of what a reverse mortgage is and how it works. We will briefly describe the reverse mortgage, cover basic requirements, the reverse mortgage loan process and what happens after the loan closes.

Hopefully, after finishing with this you will be comfortable with what a reverse mortgage is and how it works, but as always, if you have additional questions you can always reach out via our contact page or if you are in California please sign up for one of our free no obligation Munch and Learn HECM reverse mortgage events!

What is a reverse mortgage?

A reverse mortgage is essentially a mortgage that pays you the equity in your home. When you take on a reverse mortgage you essentially take the equity you have built up in your home and pay it back to yourself in a lump sum, term or tenure payments or you create a line of credit allowing you access to the equity at your convenience. A lender pays you this money and takes a lien on our property, with interest, to secure this debt. You have the right, assuming you live up to a few minor obligations, to live in the property for as long as you like or until you and your spouse pass away. You may also “cure” (payoff) the debt at any time.

The monthly interest on the funds lent to you becomes the mortgage payment and is added to the loan balance each month. Here is a very simple mathematical example:

Reverse Mortgage Initial Loan Balance $150,000

Yearly Interest Rate 5%

Monthly Interest Rate (5%/12) 0.0042%

Monthly Interest ($150,000 x .0042%) $630

New loan balance at end of month $150,630

The $150,000 lump sum payment would accrue $630 in interest at the end of one month. This would be your loan balance for the start of the next month and the loan balance would increase monthly for the life of the loan. Voila! Reverse mortgage magic!

Reverse mortgages myths!

Lets dispelled a few myths here. You are not selling your home to the bank. You retain ownership of the property and have the right to pay off the reverse mortgage at any point you see fit. Should you transition while in the mortgage, your family members or designated beneficiary will have the right to dispose of the property in the manner they see fit for a period of up to 12 months. This means they can refinance or pay the loan off and keep the property or they can sell the home to satisfy the loan and the remaining equity will be theirs.

Reverse mortgages may not be right for everyone, but for lots of individuals, couples, and families reverse mortgages are a tremendous financial tool to allow seniors the financial freedom and security owning a home WITHOUT a mortgage payment provides.

How can I get paid?

There are a number of ways to take funds with a reverse mortgage. They are a lump sum, term payments, tenure payments, line of credit or a combination of lump sum and line of credit.

Lump Sum – The loan disburses a one-time lump sum payment to you. Seniors use the remaining home equity funds to maintain the loan payments and live in the home mortgage payment free. The Lump Sum option can be, and is often, paired with the line of credit (LOC) option we will discuss momentarily.

Term Payments – Term payments are simply taking the lump sum you would have received and dividing it out over the numbers of months of your choosing. For example:

Lump Sum Distribution: $100,000

Term Months 20

Term Payment = $100,000/20 = $5000 per month

Tenure Payments – Tenure payments are like term payments but are guaranteed for life. You will receive your payment as long as you are alive and own the home and are living there. Certainly some great security, but generally substantially smaller payment amounts.

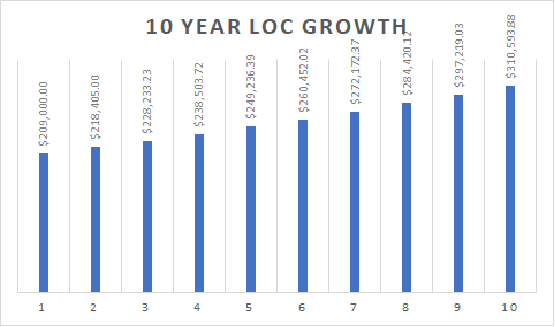

Line of Credit (LOC) – The reverse mortgage line of credit works by providing you with a reserve of funds available at your convenience. Lines of credit are stored funds that you can access when you need them.

What are the requirements?

There are a few standard requirements that you must meet in order to obtain a HECM reverse mortgage or HECM reverse purchase loan.

Age – All financially obligated homeowners must be 62 years of age or older. This means that the primary homeowners must be 62 years old or older.

Equity – The home must have equity. In most cases, equity must be 50% or greater than the value of the home. The actual equity requirement is dependent upon the age of the youngest title holder. (i.e. husband is 72 and wife is 68 then equity requirement is based on the wife’s age of 68)

Primary residence – The property that is the subject of the transaction must be your owner-occupied primary residence.

Credit – In 2017 HUD updated their financial assessment guidelines. This created much stricter credit requirements. For more details take a look at the linked post.

Income – HUD also instituted a financial assessment with minimum residual income requirements. Residual income is defined as income left after accounting for current expenses. The requirements are based on family size and region. The chart below details the requirements:

Residual Income Requirements Chart

Family Size Northeast Midwest South West

1 $540 $529 $529 $589

2 $906 $886 $886 $998

3 $946 $927 $927 $1,031

4 or More $1,066 $1,041 $1,041 $1,106

Trust the Process!

The process for obtaining a reverse mortgage is much like that of any other mortgage. There is one added step of mortgage counseling which increases protection for seniors. Let’s explore.

Step One – reverse mortgage counseling

Reverse mortgages require that all occupants of the property attend a HUD-approved reverse mortgage counseling session. Counseling must be completed before the loan process can begin.

Step Two – initial loan disclosures and loan documentation

Your loan officer will provide you with loan proposal outlining the details of the loan. They will also provide a number of loan disclosures that will need to be signed. Please be sure to read your disclosures carefully and ask questions should you not understand them. That is what the loan officer is there for.

The loan officer will also request some supporting loan documentation at this time. Typically this will include income documentation such as Social Security Award Letters or paystubs, tax returns, homeowners insurance, identification (drivers license and social security card), and any other documents pertinent to the loan.

This information will be presented to underwriting and used to qualify you for the loan.

Step Three – approval and appraisal

Once the loan application and supporting documentation have been submitted and reviewed by the underwriter, you will receive a conditional approval. The conditional approval will list additional requirements the underwriter will need to approve the loan. As long as these requirements can be satisfied, an appraisal will be ordered.

While the appraisal is prepared, you will submit any final items required on the conditional approval. Once the conditional approval items have been submitted and approved and the appraisal has returned and is satisfactory you will be ready for the loan signing.

Step Four – final approval, loan signing, and recision

Once the appraisal and all outstanding conditions are approved by the lender, loan documents will be issued. Once you have executed your loan documents you will have 3 days (not counting Sundays and holidays) to rescind or cancel the loan.

Step Five – funding and loan closing

After the 3 recision days, your loan will close and you will be obligated to the terms of your reverse mortgage. Your funds will be disbursed according to the terms of the loan and you will begin to operate under those terms moving forward.

After closing

It is important to remember that while a HECM reverse mortgage is generally quite easy to maintain, there are a few very important items to consider:

- You must continue to pay your property taxes and homeowners insurance. Failure to pay property taxes and insurance is one of the few reasons that a reverse mortgage can be foreclosed on. Some homeowners will choose and in some cases be required to have a LESA (Life Expectancy Set Aside). This account is used to pay the expected property taxes and insurance much like an impound account on a forward mortgage.

- You must also maintain the property. HUD requires that the property is maintained in satisfactory living condition. I am not aware of HUD having inspected homes for this reason, but it is a requirement and can be grounds for foreclosure.

Summary

Reverse mortgages are a very powerful tool in a senior’s financial planning arsenal. They offer tremendous flexibility and allow seniors a plethora of options to free up income, reduce debt, and remain in their home. Used properly they can increase seniors expected quality of life tremendously.

Truehecm.com

We here at truehecm.com are always listening. If you have a question or comment please reach out to us. You can comment below or you can contact us through our contact page. If you find the info helpful we would also love your feedback by giving as a 5-star review!

And, if you are in California, our HECM reverse mortgage specialists are always ready to help you determine if the program is right for you. Just drop us a line through the contact page and well get back to you ASAP!