Reverse mortgage with bad credit? We get this question all the time. Reverse mortgages have become a very valuable option for the ever-growing senior population. As is often the case, when you need a loan, sometimes, it’s hard to get one. While in the past, credit was typically not an impediment to a reverse mortgage, now there are credit standards associated with the program.

In March of 2017, Housing and Urban Development (HUD) instituted the financial assessment for HECM reverse mortgage transactions in an effort to reduce reverse mortgage delinquencies. This was an earthshaking change to the reverse mortgage market. It was feared that it would have the effect of locking reverse mortgage applicants with bad credit out to the market.

A little about what a reverse mortgage is.

As always here at truehecm.com, let’s start a the beginning by explaining what a HECM reverse mortgage is. A reverse mortgage is essentially just what it says, a mortgage in reverse. That means that rather than slowly paying your home off over time and building equity, you will use the equity you’ve already built in your home to pay you.

It may be the only way available to unlock the equity in your home as a cash benefit to you while retaining ownership of the property AND not incurring a mortgage payment! This means that the equity in the home will decrease month by month as the equity is used to pay the mortgage payments.

Reverse mortgage myths!

Lets dispelled a few myths here. You are not selling your home to the bank. You retain ownership of the property and have the right to pay off the reverse mortgage at any point you see fit. Should you transition while in the mortgage, your family members or designated beneficiary will have the right to dispose of the property in the manner they see fit for a period of up to 12 months. This means they can refinance or pay the loan off and keep the property or they can sell the home to satisfy the loan and the remaining equity will be theirs.

Don’t let the hype fool you! Reverse mortgages are not BAD! They are not right for everyone, but for lots of individuals, couples, and families reverse mortgages are a tremendous financial tool to allow seniors the financial freedom and security owning a home WITHOUT a mortgage payment provides.

What are the requirements?

There are a few standard requirements that you must meet in order to obtain a HECM reverse mortgage or HECM reverse purchase loan.

Age – All financially obligated homeowners must be 62 years of age or older. This means that anyone on the title and any existing mortgages must be 62 years old or older.

Equity – The home must have equity. In most cases, equity must be greater than 50% of the value of the home. The actual equity requirement is dependent upon the age of the youngest title holder. (i.e. husband is 72 and wife is 68 then equity requirement is based on the wife’s age of 68)

Primary residence – The property that is the subject of the transaction must be your owner-occupied primary residence. This means it must be the home you live in.

Federal debt cannot have defaulted. Government Debt Defaults – You can not have any currently defaulted government debt obligations. This means student loans, FHA mortgages, unpaid federal taxes, etc. These obligations will have to be paid off if you want to qualify for a reverse mortgage with bad credit.

What’s changed?

These general requirements for the HECM reverse mortgage loan and the HECM reverse purchase loan have been in place for some time. Unfortunately, as of March of 2017, HUD implemented their financial assessment guidelines for HECM transactions moving forward. This raised the bar for reverse mortgage transactions substantially and may have locked many borrowers out of the reverse mortgage market.

The new guidelines look at income, credit and derogatory title items when assessing a reverse mortgage applicant’s file.

The brass tacks – Income!

HUD has implemented a residual requirement when assessing an applicant’s income. This means that after obligations (bills, mortgage, taxes, payments, etc.) the borrower must have a set amount of available money on a monthly basis. The number of people living in the household determines the total “residual income” required. For households of one person, the residual income requirement is $589 and increases to a maximum of $1160 for a household of 4 or more.

Let’s clear that up a bit by illustrating a couple of items.

A “household” per HUD is the number of people who reside at the residence. This could be just the homeowners or it could include children, grandchildren, borders, or anyone else making the home their residence.

“Residual income” per HUD is the amount of money left after subtracting any debts listed on the credit report as well as housing obligations (taxes & insurance). For example:

Credit Card Payment $53

Auto Payment $254

Home Insurance & Taxes $265

Total: $572

Single Household Income $1300

Residual Income: $728

In this example, the client is single and has a 1 person household, therefore, they would need residual income of $589. In the example, they have $1300/month in income and $572/month in obligations. This leaves them with residual income of $728/month. THEY PASS! HOORAY!

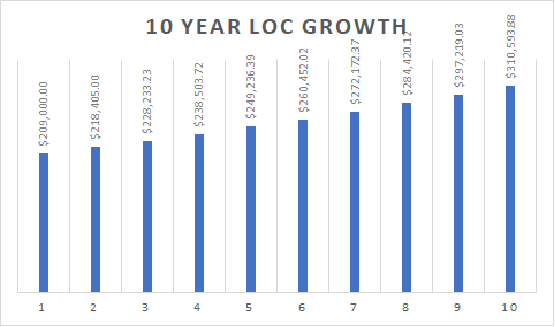

The key to passing the income requirement is the way a transaction is structured. A reverse mortgage line of credit can sometimes be the answer. If you have questions regarding income requirement please reach out to us through our contact page or comment and we will get back to you as soon as we can. We are always here to help!

Credit!

The second hurdle added was credit qualification. This can be a challenge for many clients in need of a reverse mortgage. If you have, let’s say, dented credit, HUD may take a second look. In many cases, this may mean just writing a Letter of Explanation (LOE) for the underwriter outlining why the derogatory credit occurred. In more severe cases other remedies may be required.

Reverse Mortgage with Bad Credit? DO NOT LET DEROGATORY CREDIT DISCOURAGE YOU FROM APPLYING FOR A HECM REVERSE MORTGAGE. There are many ways to skin a cat, as they say, and derogatory credit is more often than not overcome.

Often the way the derogatory item is presented in the LOE is key to passing the credit requirement and getting a reverse mortgage with bad credit?. If you have questions regarding the credit requirement please reach out to us through our contact page or comment and we will get back to you as soon as we can. We are always here to help!

The property!

Finally, in the loan process title events are scrutinized. Any delinquency, judgment, or lien will be taken in to account by the underwriter.

This category can vary tremendously according to each client and thus describing the myriad options is difficult. If you have questions regarding the credit requirement please reach out to us through our contact page or comment and we will get back to you as soon as we can. We are always here to help!

Summing up.

HUD’s financial assessment requirements have added a new layer of complication to the HECM Reverse mortgage process, therefore, obtaining a reverse mortgage with bad credit requires extra care. Ostensibly This was done to help protect HUD from rising reverse mortgage delinquencies, but it has had the effect of discouraging qualified applicants from applying. HUD may have created a solution for a problem that was already fixed. Many of the delinquencies in the reverse mortgage market are being caused by mortgages originated before new loan-to-value ratios implemented after the financial crisis.

Reverse Mortgage with Bad Credit? Don’t let the new hurdles trip you in your quest for financial freedom. The new regulations are easy for an experienced reverse mortgage consultant to deal with.

Truehecm.com

We here at truehecm.com are always listening. If you have a question or comment please reach out to us. You can comment below or you can contact us through our contact page. If you find the info helpful we would also love your feedback by giving as a 5-star review!

And, if you are in California, our HECM reverse mortgage specialists are always ready to help you determine if the program is right for you. Just drop us a line through the contact page and well get to you ASAP!

For additional reading try: